Bankrate Cd Rates

- Bankrate compares thousands of financial institutions to make it easy for you to apply for the best certificate of deposit rate. Find the best CD rates by comparing national and local rates.

- But unlike most CDs, NBKC CDs pay variable rates, so rates can go up or down after you've opened the account. Sallie Mae CD (Member FDIC): Sallie Mae pays competitive rates on short terms, but you.

- The best CD rates and accounts offer competitive APYs and a variety of term lengths. Whether from a bank or a credit union, CDs offer safety and growth.

During this period, online 1-year CD rates bottomed out in a range of 0.80% to 1.00%. The 1YrOCD Index has fallen below this range which indicates that we’re now seeing all-time low 1-year CD rates at most online banks. Why 1-year CD rates? One-year CD rates provide a good benchmark for both rate watchers and issuing financial institutions alike. Bankrate’s best 5-year CD rates March 2021 Best Overall Rate: Delta Community Credit Union – 1.25% APY, $1,000 minimum deposit High Rate: SchoolsFirst Federal Credit Union – 1.01% APY.

© Provided by Bankrate Aerial view of forest, Texture of mangrove forest from aboveAnytime you deposit into a CD, you promise to leave the money there for a set period of time. When you get a 6-month CD, the money remains in the deposit account for six months. Because you're willing to lock the money away, a bank might be willing to pay you a higher yield on the money.

Popular Searches

If you want to know how much interest you could earn on a 6-month CD, try Bankrate's calculator, which is designed to help you estimate potential earnings. Six months may not be a long time, but it can be useful when it comes to staying on track with your savings goals or setting up an emergency savings ladder.

Summary of Best 6-Month CD Rates March 2021

| Bank | APY | Minimum deposit for APY |

| Quontic Bank | 0.60% | $500 |

| Limelight Bank | 0.50% | $1,000 |

| First Internet Bank of Indiana | 0.45% | $1,000 |

| Navy Federal Credit Union | 0.45% | $1,000 |

| Bethpage Federal Credit Union | 0.40% | $50 |

| TIAA Bank | 0.40% | $1,000 |

| Bank5 Connect | 0.35% | $500 |

| Golden 1 Credit Union | 0.35% | $500 |

| Delta Community Credit Union | 0.35% | $1,000 |

| EmigrantDirect | 0.35% | $1,000 |

| SchoolsFirst Federal Credit Union | 0.35% | $20,000 |

Note: The APYs (Annual Percentage Yields) shown are as of March 1, 2021. The rates for some products may vary by region.

Above are the top widely available 6-month CD rates. Compare these offers, then calculate how much interest you would earn when your CD matures.

Savers looking to get a little extra boost and lock in a yield for a set period of time often look into certificates of deposit (CDs). A CD can help you work toward your savings goals, whether they're long-term or short-term.

CD yields tend to follow the path of Treasurys and may be impacted by the Federal Reserve's actions. However, once you lock in a yield, you can expect it to be consistent for the entire term of the CD - even if rates fall.

Here's what you need to know about using a 6-month CD to your advantage.

Bankrate’s guide to choosing the right CD rate

Why you can trust Bankrate

Bankrate has more than four decades of experience in financial publishing, so you know you're getting information you can trust. Bankrate was born in 1976 as 'Bank Rate Monitor,' a print publisher for the banking industry, and has been online since 1996. Hundreds of top publications rely on Bankrate. Outlets such as The Wall Street Journal, USA Today, The New York Times, CNBC and Bloomberg depend on Bankrate as the trusted source of financial rates and information.

Methodology for Bankrate’s Best CD Rates

At Bankrate, we strive to help you make smarter financial decisions. We follow strict guidelines to ensure that our editorial content is unbiased and not influenced by advertisers. Our editorial team receives no direct compensation from advertisers and our content is thoroughly fact-checked to ensure accuracy.

Bankrate regularly surveys around 70 widely available financial institutions, made up of the biggest banks and credit unions, as well as a number of popular online banks.

To find the best CDs, our editorial team analyzes various factors, such as: annual percentage yield (APY), the minimum needed to earn that APY (or to open the CD) and whether or not it is broadly available. All of the accounts on this page are insured by Federal Deposit Insurance Corp. (FDIC) or by the National Credit Union Share Insurance Fund (NCUA).

When selecting the best CD for you, consider the purpose of the money and when you’ll need access to these funds to help you avoid early withdrawal penalties.

Top banks offering 6-month CD rates for March 2021

Quontic Bank: 0.60% APY, $500 minimum deposit to open

Quontic Bank is an online bank that offers four terms of CDs: 6 months, 1 year, 2 years and 3 years. All CDs require a minimum of $500 to open.

Quontic Bank also offers a high-yield savings account and money market account. Both pay competitive yields and have low minimum opening deposits.

Limelight Bank: 0.50% APY, $1,000 minimum deposit

Limelight Bank is a division of Capital Community Bank. It has its headquarters in Provo, Utah.

Limelight Bank only offers CDs on its website and requires a minimum deposit of $1,000 on all four of its CD terms. You'll have to look elsewhere if you're looking for a CD with a term of longer than three years.

First Internet Bank of Indiana: 0.45% APY, $1,000 minimum deposit

First Internet Bank of Indiana was the first FDIC-insured financial institution to operate entirely online, according to the bank's website. First Internet Bank of Indiana first opened in February 1999 and is available in all 50 states.

First Internet Bank offers eight terms of CDs, a money market savings account with a competitive yield, a savings account and two checking accounts.

Navy Federal Credit Union: 0.45% APY, $1,000 minimum deposit

Navy Federal Credit Union has more than 9 million members and is the world's largest credit union. It has a global network of 340 branches. Navy Federal Credit Union has its headquarters in Vienna, Virginia.

Membership at Navy Federal Credit Union is open to all Department of Defense and Coast Guard Active Duty, civilian, contract personnel, veterans and their families.

In addition to CDs, Navy Federal Credit Union also offers checking and savings accounts, loans and credit cards.

Bethpage Federal Credit Union: 0.40% APY, $50 minimum deposit

Bethpage Federal Credit Union was founded in 1941 for people working at Grumman.

Bethpage Federal Credit Union is located in Bethpage, New York. It has more than 400,000 members and offers nine terms of CDs. The three-month CD is the shortest term and the five-year CD is the longest term. Bethpage also offers a 39-month bump-up CD.

Besides CDs, Bethpage offers checking accounts, savings accounts, loans and other financial products.

TIAA Bank: 0.40% APY, $1,000 minimum deposit to open

TIAA Bank is a division of TIAA, FSB. TIAA Bank has 10 financial centers, all located in Florida.

TIAA offers CD terms ranging from three months to five years. It also offers a Bump Rate CD, which allows a one-time rate bump if rates go higher. TIAA Bank has a service called CDARS (Certificate of Deposit Account Registry Service) for customers with high deposits who need expanded FDIC insurance coverage.

Bank5 Connect: 0.35% APY, $500 minimum deposit

Bank5 Connect is a division of BankFive. Bank5 Connect has been around since 2013 and BankFive has a history dating back to 1855.

Bank5 Connect offers CDs, a savings account and a checking account.

Golden 1 Credit Union: 0.35% APY, $500 minimum deposit

Golden 1 Credit Union has 1 million members and is headquartered in Sacramento, California. Golden 1 Credit Union has 72 branches in California, and has been around since 1933. Membership to Golden 1 Credit Union is open to all Californians.

Non-Californians can join Golden 1 Credit Union if they are a registered domestic partner or family member of a member. They can also join if they're a member of one of the select employee groups.

In addition to CDs, Golden 1 Credit Union also offers a money market account, checking and savings accounts. The credit union also has credit cards and loans.

Delta Community Credit Union: 0.35% APY, $1,000 minimum deposit

Delta Community Credit Union began as the Delta Employees Credit Union in 1940. It was started by eight Delta Air Lines employees.Delta Community Credit Union has more than 400,000 members and has 26 branches in metro Atlanta and three branches outside of Georgia.

Anyone living or working in metro Atlanta and employees of more than 150 businesses are welcome at Delta Community Credit Union. Delta Air Lines, Chick-fil-A and UPS are some of the eligible businesses.

EmigrantDirect: 0.35% APY, $1,000 minimum deposit to open

EmigrantDirect is a division of Emigrant Bank.

EmigrantDirect has CDs with terms ranging from 16 months to 10 years. All of these CDs require a $1,000 minimum deposit.

On the savings side, EmigrantDirect has its American Dream Savings Account.That savings account doesn't have fees or service charges.

SchoolsFirst Federal Credit Union: 0.35% APY, $20,000 minimum deposit

SchoolsFirst Federal Credit Union was formed during the Great Depression in 1934. The credit union, created by school employees, has 50 branches.

SchoolsFirst Federal Credit Union has low minimum balances and CD terms from as short as 30 days to as long as five years. CDs at this credit union have four balance tiers: $500, $20,000, $50,000 or $100,000.

Coronavirus and Your Money

The COVID-19 pandemic has created financial hardships for millions of Americans.

While CD rates are not likely to rise in this environment, their stability can offer some comfort to those who have extra cash on hand. The rate on a CD stays the same during the deposit term and the account holder knows exactly when that term will end. With their locked-in interest rates, CDs are also a great choice to avoid the stock market's ups and downs.

Finding the best 6-month CD rates

To find the best 6-month CD rates, savers need to answer two questions:

- How much yield can I reasonably expect to earn?

- What direction are interest rates headed?

Rates are stabilizing. If you’re looking for a short-term CD, it’s best to shop around for the best CD rates.

The lower the CD term length, the less interest you can expect to earn. To find the best 6-month CD rates, evaluate offers from online banks and credit unions. Try to avoid accounts with high fees and minimum deposit requirements.

6-month CD FAQs

Who should open a 6-month CD?

Six months is one of the shortest terms available for savers interested in CDs. It’s a product that’s best for consumers with specific short-term goals who are looking for a temporary place to keep money that will be used soon for a specific purpose, like funds for an upcoming wedding, vacation or home down payment. A six-month CD could also be a place to keep cash that you’re hoping to put into a riskier investment vehicle.

The longer the term of your CD, the higher the yield you’ll likely have at your disposal. That means 6-month CD yields are typically relatively low. Consider whether it makes more sense to keep your money in a more liquid account, like a savings or money market account. That way, you won’t run the risk of losing interest if you need the money you stashed away before the six month time clock runs out.

Comparing 6-month CDs vs. other savings vehicles

When considering a 6-month CD, it's a good idea to compare it to other available accounts and understand when it might be the right choice for you - and when other options might turn out to be a better decision.

6-month CD vs. savings account

Because you're willing to keep your money in a CD for a set period of time, you usually end up with a higher rate with a CD than a savings account. In fact, you might have a rate that is up to 10 basis points higher on a 6-month CD than on a savings account.

However, savings accounts are more accessible. With a savings account, you won't face the early withdrawal penalties like you do if you tap your 6-month CD before it matures.

6-month CD vs. money market account

There's a good chance you'll get a better yield on a 6-month CD than on a money market account. So, if you're looking for a better yield in a safe account, it can make sense to use a CD instead of a money market account.

On the other hand, a money market account is much more accessible than a 6-month CD. You might even be able to use a debit card to access the funds in the money market account - something you can't do with a CD.

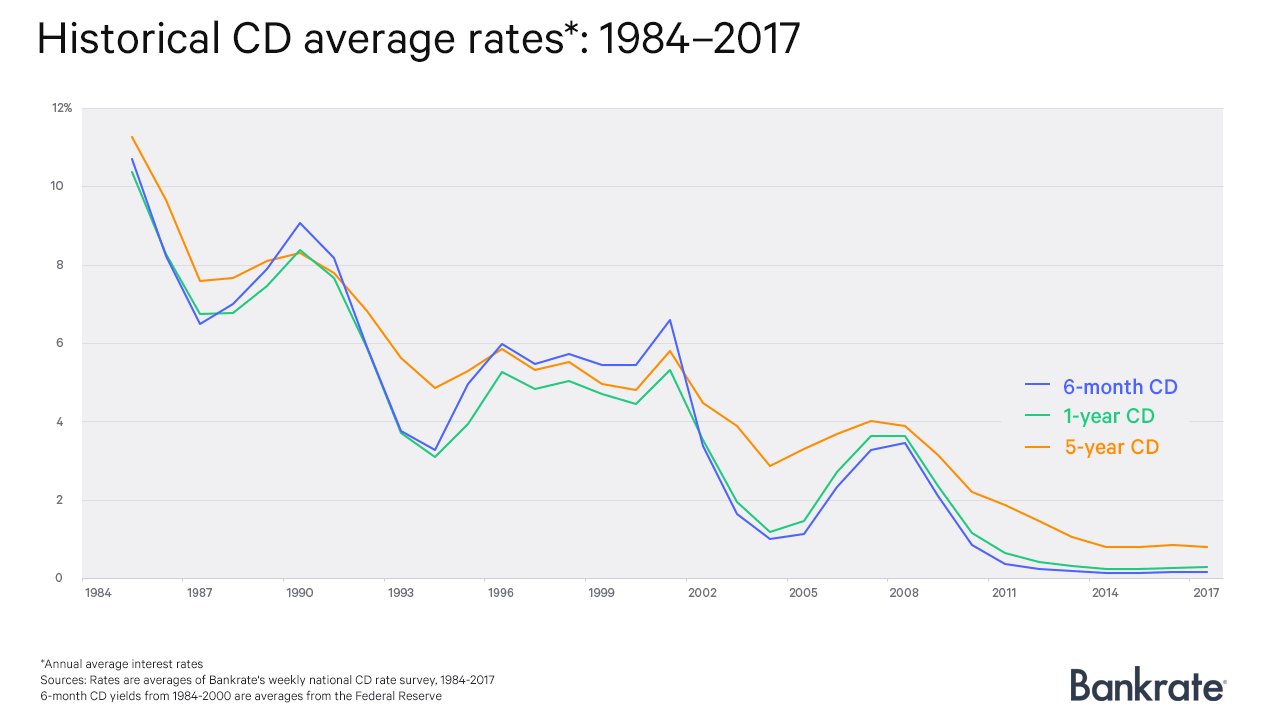

6-month CD vs. 1-year CD vs. 5-year CD

Better yields are generally available on CDs with longer maturities. So, if you're willing to lock up your money for a year - or even up to five years - you could receive a better rate.

However, the advantage of a 6-month CD is that you know you'll be able to access the money in a shorter time frame. Because a CD typically comes with an early withdrawal penalty, you have to be willing to keep your money in the CD until the end of the term or lose out on some of the interest earnings.

How to make the most of a 6-month CD

A 6-month CD works well with short-term savings goals. If you want to set money aside for a specific purpose, but you're worried that you'll be tempted to tap into the funds, a 6-month CD can help make the money harder to get to. You can keep the money safe in an FDIC-insured (or NCUA-insured) account until it's needed.

You can also make use of a 6-month CD in an emergency fund ladder. By setting up a CD ladder that includes shorter-term CDs, it's possible to take advantage of slightly higher yields while knowing that a portion of your money will be available for unexpected expenses in the near future.

Maximize the power of compound interest

Anyone struggling to save money could benefit from having a 6-month CD. Because you could face an early withdrawal penalty, you may be less tempted to tap into your savings prematurely.

Annual percentage yield, or APY, includes the effect of compounding. It's the interest earned on your initial deposit in addition to the interest earned on top of other interest earnings.

Things to keep in mind with a 6-month CD

Before you get a 6-month CD, it's important to understand the potential drawbacks. The early withdrawal penalty is probably the biggest issue. If you access your funds before the six months is up, you'll pay a penalty.

Plus, the yield often isn't much higher on a 6-month CD than you'd see with a traditional savings account. You can shop around for the highest rates, but you might need to meet deposit minimums in order to take advantage of the best yields.

Carefully consider your options before you move forward with a 6-month CD.

Recap: Best 6-month CD rates

- Quontic Bank: 0.60% APY, $500 minimum deposit

- Limelight Bank: 0.50% APY, $1,000 minimum deposit to open

- First Internet Bank of Indiana: Up to 0.45% APY, $1,000 minimum deposit

- Navy Federal Credit Union: 0.45% APY, $1,000 minimum deposit

- Bethpage Federal Credit Union: 0.40% APY, $50 minimum deposit

- TIAA Bank: 0.40% APY, $1,000 minimum deposit

- Bank5 Connect: 0.35% APY, $500 minimum deposit

- Golden 1 Credit Union: 0.35% APY, $500 minimum deposit

- Delta Community Credit Union: 0.35% APY, $1,000 minimum deposit

- EmigrantDirect: 0.35% APY, $1,000 minimum deposit

- SchoolsFirst Federal Credit Union: 0.35% APY, $20,000 minimum deposit for APY

Learn more about other CD terms:

Learn more about CDs:

Advertiser DisclosureCertificates of deposit, or CDs, are powerful, interest-bearing investments that reward investors for leaving cash untouched for a fixed period of time. A CD calculator can help you to know how much you can expect to make on your investment and how much to invest to reach your financial goal.

How to calculate CD earnings

Using a CD calculator is simple. Input the basic information about the CD option you're looking at, and click the calculate button. The information you'll need is your initial deposit size, how long the CD is invested for and the APY rate offered.

You can compare different scenarios by changing out these numbers to see the effects it will have on your total ending balance, interest earnings, total earnings and how that matches up against the current national average.

Cd Rates Florida

- Initial deposit: The amount of money you initially invest in your CD

- Period (months and years): The time period that your CD is for. This is the period of time you're expected to leave your funds untouched to get maximum gains.

- APY: The annual percentage yield (APY) is the percentage rate of return you'll see over the course of one year. APY, as opposed to the interest rate, does take into account the effects of compound interest.

- Total balance: The amount you should have available for withdrawal at the end of your CD investment term.

- Interest earnings: The portion of your earnings that come from interest

- Your earnings: The total earnings you'll see at the end of your CD term, including interest and the effects of compounding

- National average: The amount you would earn with a CD that mirrored the current national average rate of return

Why use a CD calculator

As long as you're getting a CD through a trusted banking partner that is FDIC insured or NCUA insured, the major difference between options will be the rate of return. CD calculators allow you to quickly determine how much you're going to make with a particular CD option. If you're looking to meet a particular savings goal, a CD calculator lets you quickly change period lengths, deposit amounts and APY rates to find the right option.

How to pick the best CD provider

The first thing you should look for when selecting a CD provider is whether it is FDIC- or NCUA-insured or not. You will want to stick to investing in financial institutions that have government backing of the funds.

From there, you'll want to look at the APY rates to see where you might get the best return. Remember, APY rates will vary based on the term of the CD and also may vary based on the amount of money you have invested. Always take the time to compare the best CD rates to make sure that you're locking your money into the right account.

Lastly, make sure you look at the early withdrawal penalties. Not all institutions assess the same penalties. Ideally, you'll keep the money in the CD until maturity, but it's good to know what will happen if you find a sudden need for the money.

What happens if you withdraw early

Bankrate Cd Rates Jumbo

Unless you're taking advantage of a no-penalty CD like the ones offered through Ally Bank, you will incur an interest penalty if you withdraw your funds early. The idea of a CD is that the bank knows it can use your funds for different operations during the fixed period. When you withdraw early, the bank will assess a penalty because of this.

Bankrate Cd Rates

Different financial institutions will have different withdrawal penalties. For example, Alliant Credit Union will take back the interest earned up to 120 days for a CD that is open 18 to 23 months. Ally Bank will only take up to 60 days of interest for CDs 24 months or less. Keep in mind that the bank or credit union won't take any of your initial deposit as a penalty.