Capitec Savings Account

Capitec Bank Accounts

Below are some salient informations about the Capitec Bank Accounts. How to open an account and some various forms of accounts in the Capitec Bank are provided.

To open your account, we need the following 2 documents from you:

- Original identification document

- Original proof of residential address document

- If you are liable to pay tax in a country other than South Africa we require your foreign tax number

Q: HI.I will like to know what exactly do i need to do if i want to start saving money for rainy days.assuming that i deposit R500 per month in my account for the next 10months.how much will i get at the end of my depositing term or whatsoever.lets call it a short term investment.please provide me with full information on what to do and where to go.am having an account with capitec bank.thank you. 10 things to know when you open a Capitec Bank account: 1. It's FREE # Mahala 2. Based on your decision, you're probably a genius 3. Your first card is FREE and printed immediately in-branch 4. Kids and unemployed people CAN (and should) join us 5. Bring your ID 6. Most banks let you compare different kinds of accounts to help you decide. Do you want an individual account or do you want to open a joint account online? Do you want things like overdraft protection and the ability to earn interest? From checking and savings accounts to CDs and IRAs, there are many types of accounts you can open online.

We will scan and keep a record of these for identification and verification purposes.

Documents we accept

Find out more about all the documents you need: FICA documents info

Some options will require a FICA Declaration form that you can get at any of our branches or download here: FICA Declaration form

Capitec Savings Account Card

Important note on all documents

- Certified copies of original documents are only accepted in the case of rental or lease agreements and marriage or birth certificates

- Temporary identity documents or passports are not acceptable

- A valid version of the document means that it must be current and unexpired

- FICA requires that all client information be correct and up to date. It is therefore important that you notify us of any changes to your identity or residential address details. Visit your nearest branch with your identification document and original proof of residential address to update your details

Transaction and savings

The transaction and savings account is your main account (R25 minimum balance; R5.80 monthly admin fee) that gives you affordable banking and up to 4 extra flexible, fixed or tax-free savings plans.

Benefits

Some of the benefits of the transaction and savings account:

- Access to Mastercard® Priceless® Cities worldwide

- Earn from 4.85% interest per year on daily balances

- Easiest transactions at lower, transparent bank costs

- Easy access to your money using our app, cellphone *120*3279#, the Internet and your Global One card

- Fix the money in any of the 4 additional savings plans and earn up to 9.1% interest

Transaction and savings account interest rates

| Amount (R) | R0 – R9 999 | R10 000 – R24 999 | R25 000 – R99 999 | R100 000+ |

| Interest rate (%) | 4.85 | 4.85 | 5.15 | 5.40 |

All interest rates quoted are nominal annual compounded monthly (NACM) rates.

Flexible savings plan

Choose the deposit amount and the frequency of your deposits.

Benefits

The benefits of the flexible savings plan:

- Earn from 4.85% interest per year on daily balances

- Choose your deposit amount and the frequency of your deposits

- Choose a name for your plan

- Access your plan any time through Remote Banking or our ATMs

- No monthly admin fee or minimum balance

Use our app to open a flexible savings plan

Create a flexible savings plan the easy way:

- Open our app

- Tap on Save

- Enter your Remote PIN

- Tap on Add Flexible Savings

Interest rates

| Amount (R) | R0 – R9 999 | R10 000 – R24 999 | R25 000 – R99 999 | R100 000+ |

| Interest rate (%) | 4.85 | 4.85 | 5.15 | 5.40 |

All interest rates quoted are nominal annual compounded monthly (NACM) rates.

This is a complete list of the best savings accounts in South Africa 2021.

As Grant Cardone would usually say, store 40% of your income every month, if you want to enjoy financial freedom in the future.

Saving money is never easy with the cost of living in South Africa.

How would you find the best savings account that offers access to money when you need it and the best annual interest rate?

We'll list the top savings account that offers great benefits in South Africa.

Let's get started.

Savings Account Benefits

Opening a savings account with a bank must give you peace of mind knowing your money is kept safe and will grow in investments over time.

Secondly, what determines a great savings account would be the annual interest rate and easy access to cash.

Look:

If you don't open a savings account, you could misuse the money or risk losing your money.

So, before you think of opening a savings account, it would be wise to shop around and do some good research. This will help you find savings account that best suit your financial plans.

Whichever savings account you're going to go with must pay interest on money in your account. Also, the bank will contribute to your account every month.

The rates depend on the minimum deposits and of course, the bank policies. Some banks pay higher savings account rates due to competition.

Now, here's the best savings account you can choose from in South Africa.

The Best Savings Account in South Africa

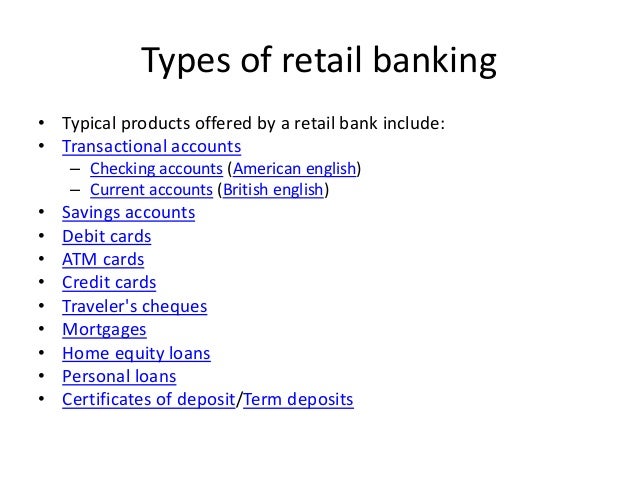

South African banks offer various types of savings account, e.g. fixed and tax-free savings accounts.

These accounts were created to assist the working class in South Africa to secure their hard-earned money.

1. FNB Savings Account

FNB helps people save and invest money for unforeseen emergencies and expenses.

Capitec Bank Opening Account

The account offers a maximum of 6.05% interest rate per year.

You'll have immediate access to your savings at no fee.

2. Capitec Bank Save

Capitec Bank is popularly known for its offering savings account to students, low-income, and the middle working class.

They offer four different types of savings account:

Transaction and savings - A minimum of R25 earning a minimum of 4.75% interest per year.

A flexible savings plan - You get to choose the amount you'd like to save and the frequency of your deposit. Earn a minimum of 4.75% interest per year with access to the savings anytime.

A fixed-term savings plan - Invest a single amount from R10 000, choose the terms between 6 - 60 months, and earn up to 8.55% interest.

Tax-free savings account - Invest money in your Capitec savings tax-free account and earn interest from R1. Your total savings will not be taxed during the withdrawal unless you've saved over R500 000.

3. African Bank Fixed Deposits

With a minimum deposit of R500, you can earn a maximum interest rate of 10.75% annual payout.

Depending on the terms you choose, African bank offers the best rates in South Africa.

Use the African Bank savings calculator to guide your investments.

4. Absa Tax-Free Savings Account

Invest from R1 000 into the Absa account without paying tax on the interest earned.

You'll have access to the money whenever you need it. There are no monthly fees, so you can add funds into your savings account whenever you want.

You can only save up to R33 000 per year according to tax laws to avoid penalties from SARS.

5. Bidvest Bank Savings Account

Depending on the duration of the investment, you put in a minimum of R10 000 into the Bidvest savings account. Earn up to 7.88% when you invest for 12 months.

It's a fixed deposit account which means you invest once and benefit from the interest charge per month.

They also offer other savings account that requires a minimum of R1 000 but a low-interest rate of 3.2%.

How to open a savings account

All you need to open a savings bank account in South Africa is your SA ID book or valid passport and proof of residence.

Some banks require a minimum deposit into your savings account, so you would need to ask customer service for more details.

Set up a goal and select how long you would like to keep your money in the savings account.

You can open the account online or in-person at the bank. You would need to submit the above-mentioned document in both application methods.

Once your account is active, you can start your saving journey and enjoying the benefits.

Spending your savings

You had a big plan with the money you kept in the savings account. Spend the money however you feel fit - the choice if completely yours.

Capitec Savings Account Calculator

- Maybe you were saving for a major purchase such as a car you love so much.

- You saved money for vacations with the beloved family.

- Perhaps, it's just an emergency savings account, you know best.