Current Deposit Account

Instant deposits is a new feature that allows Current users to deposit money from a bank account directly to their Current wallet, or their teen’s Current wallet. To qualify for instant deposits you need to have completed the free trial period, paid your annual subscription, and have a. Find the best CD rates by comparing national and local rates. A Certificate of Deposit is a type of savings account that has a set interest rate and withdrawal date. Typically, CD interest rates. Current Deposit Account is the net flow of current transactions with no restriction, including services and interest payments. It is an easy-to-use, convenient current account with instant access and withdrawals to your money anywhere in Bangladesh.

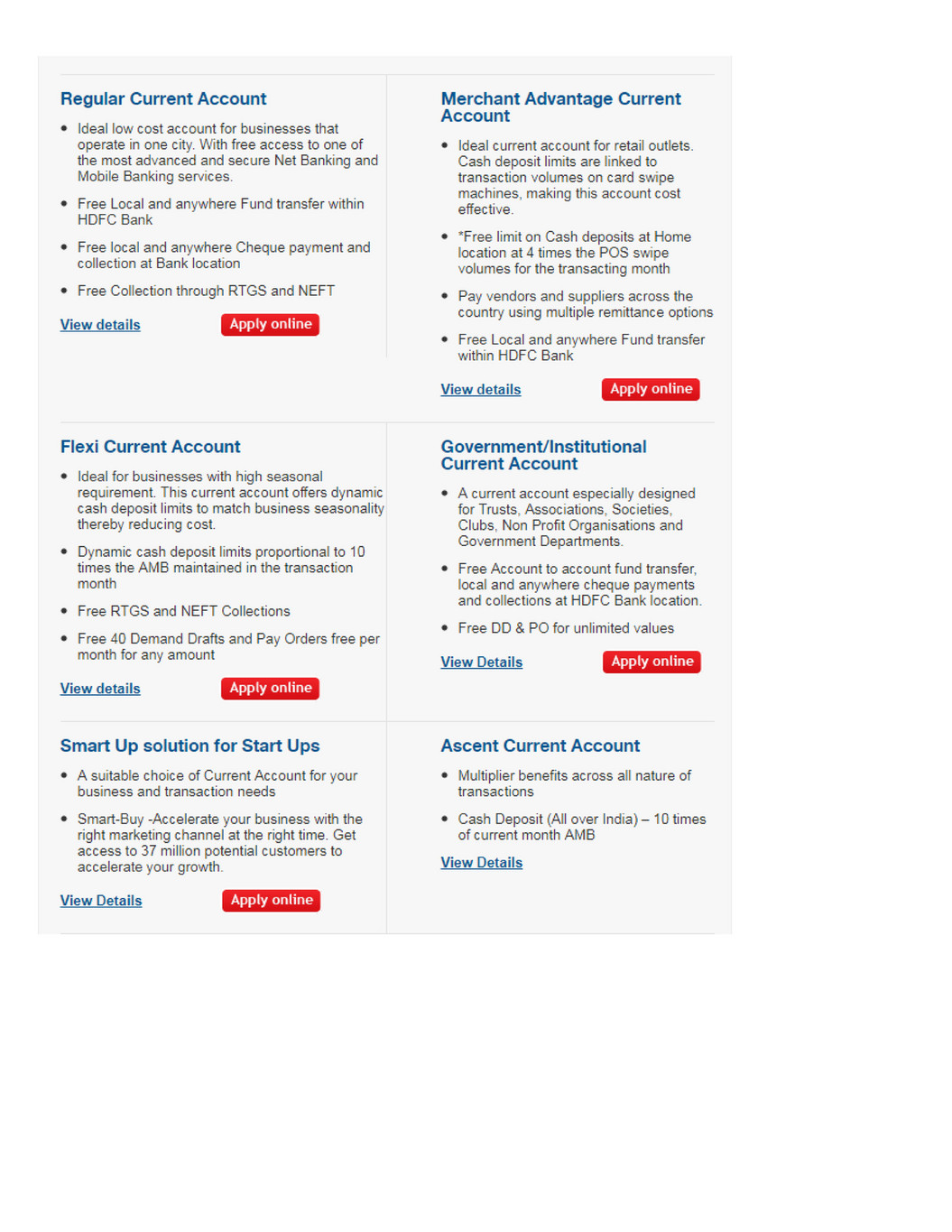

Current Deposit Account Features

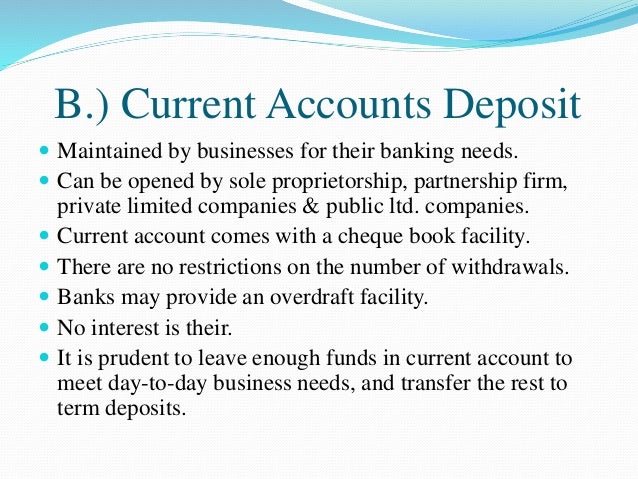

Current bank account is opened by businessmen who have a higher number of regular transactions with the bank. It includes deposits, withdrawals, and contra transactions. It is also known as Demand Deposit Account.

Current account can be opened in co-operative bank and commercial bank. In current account, amount can be deposited and withdrawn at any time without giving any notice. It is also suitable for making payments to creditors by using cheques. Cheques received from customers can be deposited in this account for collection.

In India, current account can be opened by depositing Rs.5000 to Rs. 25,000. The customers are allowed to withdraw the amount with cheques, and they usually do not get any interest. Generally, current account holders do not get any interest on their balance lying in current account with the bank.

Current account holder get one important advantage of overdraft facility.

Features of Current Bank Account

The main features of current account are as follows:-

Current Deposit Account Carries No Interest

- Current bank accounts are operated to run a business.

- It is a non-interest bearing bank account.

- It needs a higher minimum balance to be maintained as compared to the savings account.

- Penalty is charged if minimum balance is not maintained in the current account.

- It charges interest on the short-term funds borrowed from the bank.

- It is of a continuing nature as there is no fixed period to hold a current account.

- It does not promote saving habits with its account holders.

- Banker requires KYC (Know your Customers) norms to be completed before opening a current account.

- The main objective of current bank account is to enable the businessmen to conduct their business transactions smoothly.

- There is no restriction on the number and amount of deposits.

- There is also no restriction on the number and amount of withdrawals made, as long as the current account holder has funds in his bank account.

- Generally, bank does not pay any interest on current account. Nowadays, some banks do pay interest on current accounts.

Advantage of Current Bank Account

The advantages of current account are as follows:-

- Current account is mainly opened for businessmen such as proprietors, partnership firms, public and private companies, trust, association of persons, etc. that has a large number of daily banking transactions, i.e. receipts and/or payments.

- It enables businessmen to carry out their business transactions properly and promptly.

- The businessmen can withdraw from their current accounts without any limit, subject to banking cash transaction tax, if any levied by the government.

- Home branch is that location where one opens his bank account. There are no restrictions on deposits made in the current account opened in a home branch of a bank. However, the current account holder can deposit the cash from any other branch of a bank other than the home branch by paying a nominal charge as applicable.

- It helps businessmen to make a direct payment to their creditors by issuing cheques, demand-drafts or pay-orders, etc.

- It enables a bank to collect money on behalf of its customers and credits the same in their customers' current accounts.

- It enables the current account holder to obtain overdraft (short-term borrowing) facility.

- The creditors of the account holder can get credit-worthiness information of the account holder through inter-bank connection.

- It facilitates the industrial progress of the country. Without its help, businessmen would face difficulties in running their businesses.

- It has the facilities of Internet-banking and mobile-banking to carry out important business transactions with ease and quickly.

- It also provides various other advantages (benefits) such as:

- Deposit and withdrawal of money (cash) at any location.

- Multi-location funds transfer,

- Electronic funds transfer,

- Periodical (monthly, quarterly or yearly) e-mail or download of bank statements in various formats like '.XLS', '.TXT', '.PDF', etc.

- Support from customer care executives

Source:Portal Content Team