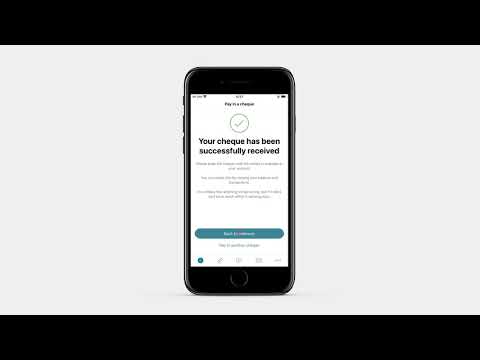

First Direct Pay In Cheque

Who can apply?

You. Probably. If you're over 18, a UK resident, haven't been declared bankrupt or registered for an Individual Voluntary Agreement in the last six years (or be in the process of doing so), and have a phone number and email address we can contact you with, we'd love to welcome you.

HSBC, First Direct, M&S Bank and John Lewis Finance borrowers who have fallen behind on repayments between 2010 and 2019 may get up to £100 in compensation after receiving a substandard level of service – and it's not a scam, despite some confusion caused by letters arriving out of the blue. HSBC, First Direct, M&S Bank and John Lewis Finance borrowers who have fallen behind on repayments between 2010 and 2019 may get up to £100 in compensation after receiving a substandard level of service – and it's not a scam, despite some confusion caused by letters arriving out of the blue. Probably not, though your first check might be a paper one. Most employers these days pay via direct deposit and house their paystubs online. You’ll need to provide your banking information (routing number and account number) so your wages can be deposited directly into your account (usually a. Pay in a cheque on the App first direct Home Help Banking with us Paying in a cheque using the App Paying in a cheque using the App FAQs for paying in a cheque using the App.

Sweep your change into your savings

A 1st Account also gives you the option to set up a 'sweep', which automatically moves any spare money from your 1st Account to a first directSavings Account on any date you choose.

Regular Saver Account

Get into a good savings habit and the future you will say thanks. Put away between £25 to £300 each month, for a fixed 12 month term, and we'll give you a fixed rate of 1.00% AER/gross p.a. Find out more about our Regular Saver Account.

Interest example: if you save £300 every month for 12 months and qualify for the 1.00% AER/gross p.a. interest rate, you'll earn approximately £19.50 interest (gross).

Pay Cheque Or Check

AER stands for Annual Equivalent Rate. This shows you what the rate would be if interest were paid and compounded each year. Gross is the rate of interest if interest were paid and not compounded each year. No partial withdrawals allowed.

Date:

First Direct Pay In Cheque Post Office

The EIP belongs to the Social Security or SSI beneficiary. It is not a Social Security or SSI benefit. A representative payee should discuss the EIP with the beneficiary. If the beneficiary wants to use the EIP independently, the representative payee should provide the EIP to the beneficiary. If the beneficiary asks the representative payee for assistance in using the EIP in a specific manner or saving it, the representative payee can provide that assistance outside the role of a representative payee.