Icici Bank Fixed Deposit

- Icici Bank Fixed Deposit Calculator

- Icici Bank Fixed Deposit Schemes

- Icici Bank Fixed Deposit Interest

- Icici Bank Fd

Check out the latest fixed deposit rates in SBI, ICICI Bank, HDFC Bank, PNB and Axis Bank. FD interest rates SBI (below Rs 2 crore) effective January 8, 2021: SBI FDs between seven to 45 days will. ICICI bank staff (including retired staff) will get additional 1% rate of interest on domestic deposit below ₹ 2 Cr. ICICI Bank Golden Years FD Rates (w.e.f 20 may'20) Now get an exclusive additional interest rate of 0.30% per annum on your Fixed Deposits above 5 years tenure. Fixed Deposit Monthly Income Scheme: ICICI Bank offers fixed term deposit with monthly income option for resident individuals, singly or jointly with flexible options. Apply for a fixed deposit monthly income plan for a tenure of your choice. Receive 30% amount as lump sum on maturity of the investment and remaining 70% as a monthly income.

This article lists down the first hand experience of obtaining ICICI Bank Coral Credit Card against a Fixed Deposit (FD) by Yokesh, an avid reader of CardInfo. He recently acquired ICICI Bank Coral Credit Card against fixed deposit and wanted to share his experience for the benefit of other readers. So let’s dive right in to know more about the process and his experience.

While ICICI is a famous brand in the banking industry, its market share of credit cards is not at par with its banking business. However they are aggressively trying to capture more share in the credit card market which is evident from the exclusive online and spend based offers. This is really good for credit card enthusiasts as they get more choices and better offers.

Motivation

I recently decided to go for a Credit Card against a fixed deposit since the ones I currently hold are add on cards from my mom’s and dad’s credit cards. Given that I don’t have a credit history, obtaining a credit card on my name would help me in building one. While looking for a credit card against fixed deposit, I searched through various options and I stumbled upon CardInfo. The article on credit cards against fixed deposit was very elaborate and informative.

One thing that differentiates ICICI Bank Coral Credit Card is that it’s available as both secured and unsecured unlike BOB Prime, SBI Unnati, Axis Insta Easy, Kotak Aqua Gold etc. It means that the moment you take it out of your wallet it doesn’t immediately show that it’s a secured Credit Card and might be helpful while applying for an unsecured credit card on card-on-card basis later, however I’m not sure.

Features

ICICI Coral Credit Card is a lifestyle credit card with multiple benefits across dining, shopping and entertainment.

- Min. Fixed Deposit Amount: Rs. 20,000

- Credit Limit: Up to 85% of FD

- Eligibility Age: Min. 19 Years

- Joining Fee: Rs. 500

- Renewal Fee: Rs. 500, waived if annual spends for last year >= Rs. 1,25,000

- 2 Payback Points per Rs. 100 spent, 0.50% reward rate

- 4 Payback Points per Rs. 100 spent on dining, groceries and at supermarkets, 1% reward rate

- 25% discount up to Rs. 100 on purchasing two movie tickets at BookMyShow, twice in a month

- 1 complimentary domestic airport lounge access per quarter

- 15% discount when dining at restaurants participating in Culinary Treats

- 1% fuel surcharge waiver

- Online offers on ICICI credit cards from time to time

This card will make you eligible for Amazon Pay ICICI Bank Credit Card which has fantastic reward rate and benefits. However, since my pin code is not serviceable, I couldn’t get it which is a bummer.

Application Process

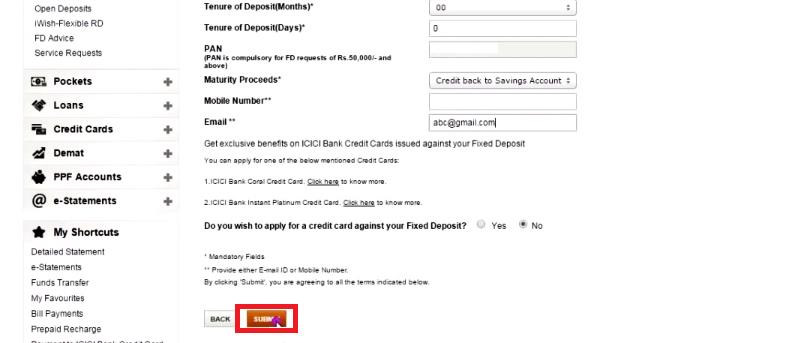

I opened a savings account with ICICI on 12th March 2020, 2 days after receiving my PAN CARD. Since mine is a semi urban branch, MAB is NIL when funded initially. I accessed the ICICI Bank iMobile app the same day in the evening using the Debit Card. After logging in, I navigated to Accounts & Deposits → Deposits → FD Xtra and was presented with following screen:

Upon tapping on “Open Now” in FD Card section, I was was asked for Fixed Deposit details as shown below:

I entered the details about fixed deposit amount, tenure etc. Note that you need to keep the auto renewal on otherwise the credit card will be deactivated once fixed deposit matures.

On scrolling down, I was presented with a choice of credit card. You can opt for either Platinum or Coral Credit card.

I opted for the Coral Credit Card and the moment I selected the same, it showed the joining fee as Rs. 500 and clauses for waiver of annual fee. You can type the name to be printed on the credit card, and the communication address is the same as the one in your savings account. I completed the simple process which didn’t take more than 2 minutes.

After submitting the application in the iMobile app, I received an SMS confirming the opening of Fixed Deposit next day morning.

Your deposit xxx for RS.50,000 has been opened on 12/03/2020.

Later in the evening same day, I received an SMS informing me the initiation of lien on my fixed deposit.

Your service Request SRXXX has been registered and will be completed in 9 Business days.

After 4 days, I received an SMS confirming the lien on my fixed deposit.

Lien of Rs.50,000/- marked against Deposit xxx on 13/03/2020.

On the same day I received an SMS stating my credit card application is approved and the same would be delivered in the next 7 working days. Later I received a message saying my card has been linked to my user id and the same can be accessed via Internet Banking or iMobile app. I checked iMobile immediately, but I couldn’t see the card. However when I tried after 2-3 hours, I was able to see the new credit card.

The credit limit provided was 90% of the fixed deposit amount which is awesome. I couldn’t use the card online on some e-commerce portal as CVV was not visible in the app. However I was able to pay using the credit card via iMobile app through Bharath QR scan to pay option.

I received the card after 3 days via BlueDart. The card looks and feels nice and was issued on Visa platform. I was a little surprised to see the PayBack number printed on the card below the cardholder name. The welcome letter contained details like credit and cash limit as usual but has no mention about the fixed deposit.

Bottomline

Overall the process was very smooth and hassle free. The process of opening the fixed deposit and getting a credit card against it, was seamless in iMobile App. ICICI has nailed the experience making it super delightful for end users. I feel this is a really good credit card to start building your credit history.

Have you ever tried getting a secured credit card against a fixed deposit? How has been your experience? Let me know by leaving a quick comment below.

© Jocelyn Fernandes Fixed Deposit rates: Check out FD interest rates in SBI, ICICI Bank, HDFC Bank PNB and Axis BankFor tenures ranging from 7 days to 10 years, top banks like State Bank of India (SBI), HDFC Bank, Punjab National Bank (PNB), ICICI Bank and Axis Bank offer fixed deposits (FDs). Before parking your money any FD deposit, it's always important to compare the FD interest rates offered by various banks.

This month SBI and Axis Bank revised the interest rates on term deposits. Check out the latest fixed deposit rates in SBI, ICICI Bank, HDFC Bank, PNB and Axis Bank.

FD interest rates SBI (below Rs 2 crore) effective January 8, 2021:

SBI FDs between seven to 45 days will now fetch 2.9 percent. Term deposits between 46 days to 179 days will give 3.9 percent. FDs of 180 days to less than one year will fetch 4.4 percent. Deposits with maturity between 1 year and up to less than 2 years will give 10 bps more now. These deposits will fetch an interest rate of 5 percent instead of 4.9 percent. FDs maturing in 2 years to less than 3 years will give 5.1 percent. FDs with 3 years to less than 5 years will offer 5.3 percent and term deposits maturing in 5 years and up to 10 years will continue giving 5.4 percent after the latest revision.

Days

Interest rates

7 days to 45 days

2.9%

46 days to 179 days

3.9%

180 days to 210 days

4.4%

211 days to less than 1 year

4.4%

1 year to less than 2 years

5%

2 years to less than 3 years

5.1%

3 years to less than 5 years

5.3%

5 years and up to 10 years

5.4%

FD interest rates Axis Bank (below Rs 2 crore) effective January 4, 2021:

Icici Bank Fixed Deposit Calculator

Across different tenures, Axis Bank offers FDs ranging from 7 days to 10 years. The bank gives interest on FDs ranging from 2.5 percent to 5.50 percent for general customers. On select maturities, Axis Bank offers a higher interest rate to senior citizens. The bank offers interest ranging from 2.50 percent to 6 percent to senior citizens.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

90 days to 120 days

3.5%

120 days to 180 days

3.75%

180 days to 360 days

4.40%

2 years to less than 3 years

5.4%

3 years to less than 5 years

5.4%

5 years and up to 10 years

5.5%

FD interest rates Punjab National Bank (below Rs 2 crore) effective January 1, 2021:

On fixed deposits maturing in the range of 7 days to 10 years, PNB is offering an interest rate ranging between 3 percent and 5.30 percent. On 7-45 days fixed deposits, PNB is offering an interest rate of 3 percent and it goes up 4.5 percent on less than 1 year FDs. PNB gives 5.20 percent interest on term deposits maturing in one year to up to 3 years. On deposits maturing above 5 years to 10 years, PNB is offering 5.30 percent interest. The Senior citizens shall get an additional rate of interest of 50 bps over applicable card rates for all maturities on domestic deposits of less than Rs 2 crore.

Days

Interest rates

7 days to 45 days

3%

46 days to 90 days

3.25%

91 days to 179 days

4%

180 days to 270 days

4.4%

271 days to less than 1 year

4.5%

1 year to 3 years

5.2%

3 years to 5 years

5.3%

Icici Bank Fixed Deposit Schemes

5 years and up to 10 years

Icici Bank Fixed Deposit Interest

5.3%

FD interest rates HDFC Bank (below Rs 2 crore) effective from November 13, 2020:

On deposits between 7 days and 29 days, HDFC Bank offers a 2.50 percent interest rate. 3 percent on deposits maturing in 30-90 days. On 91 days to 6 months, 3.5 percent and on 6 months 1 day to less than one year, 4.4 percent. The bank gives 4.9 percent on FDs maturing in one year. Term deposits maturing in one year and two years will fetch an interest rate of 4.9 percent. FDs maturing in 2 years to 3 years will give 5.15 percent, 3 years to 5 years will give 5.30 percent. Deposits with a maturity period of 5 years to 10 years will give 5.50 percent interest.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

Icici Bank Fd

3%

91 days to 179 days

3.5%

180 days to 365 days

4.4%

365 days to less than 2 years

4.9%

2 years to 3 years

5.15%

3 years to 5 years

5.3%

5 years and up to 10 years

5.5%

FD interest rates ICICI Bank (below Rs 2 crore) effective from October 21, 2020:

ICICI Bank gives 2.5 percent interest on deposits maturing in 7 days to 29 days, 3 percent for 30 days to 90 days, 3.5 percent for FDs maturing in 91 days to 184 days. On deposits maturing in 185 days to less than 1 year, ICICI Bank gives an interest rate of 4.40 percent. Term deposits maturing in 1 year to less than 18 months will fetch an interest rate of 4.9 percent. Now, FDs with tenure of 18 months to 2 years will give you 5 percent interest. Term deposits maturing in 2 years to 3 years will give 5.15 percent, 3 years to 5 years 5.35 percent, and 5 years to 10 years 5.50 percent.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

91 days to 184 days

3.5%

185 days to 365 days

4.4%

1 year to less than 1.5 years

4.9%

1.5 years to 2 years

5%

2 years to 3 years

5.15%

3 years and up to 5 years

5.35%

5 years to 10 years

5.5%